The Ramp Blog

search

Search...

Article - 4 min read

The end of manual accounting

Victor Pires

Senior Product Marketing Manager, Ramp

Article - 3 min read

Ditch the spreadsheet. Track your budgets in Ramp.

João Tranquez

Senior Product Marketing Manager

Article - 3 min read

How small finance teams are scaling like big ones

Abby Carrier

Director, Product Marketing

Article - 5 min read

How 1,000+ teams automated expense reviews — and eliminated hidden risk

Lucia Kim

Senior Product Marketing Manager

Article - 3 min read

Your January just got easier: Introducing 1099 filing

Patrick Keating

Lead Product Manager, Ramp

Article - 4 min read

Ramp x MedPro Systems: Automating compliance for life sciences teams

Joey Diab

Head of Technical Partnerships, Ramp

Article - 5 min read

Ramp at $32 billion: Money talks. Now it thinks.

Eric Glyman

Co-founder & CEO, Ramp

Editor's picks

Article

The end of manual accounting

Starting today, the race to close is no longer a chase. Meet Ramp’s Accounting Agent — built to code and review every dollar of spend.

Article

Ditch the spreadsheet. Track your budgets in Ramp.

Meet Ramp Budgets, a real-time budget tracking solution that monitors all your spend — live and integrated into a single AI-powered platform.

Article

Ramp at $32 billion: Money talks. Now it thinks.

Our CEO on the Age of "Thinking Money" and why getting big no longer means getting slow.

Customer Story

How Poshmark exceeded their free cash flow goals with Ramp

Learn how Poshmark achieved its free cash flow goals in seven months instead of 12 and cut its monthly close time in half after moving to Ramp.

Get fresh finance insights,

bi-weekly

Helpful resources

Alternatives

Compare leading finance platforms in head-to-head breakdowns and see how each one stacks up against pricing, features, scalability, and more.

Compare Business Credit Cards

Explore business credit card options by rewards, fees, credit requirements, and benefits to find the best fit for your company’s financial needs.

Accountant directory

Discover experienced accountants and bookkeepers. Find trusted professionals to handle your financial matters with expertise and precision.

Product releases

The Ramp team releases updates every week. See the latest innovations designed to help your business save time and money.

Newsroom

View all

Article

The end of manual accounting

Ramp’s Accounting Agent is built to code and review every dollar of spend, move routine work forward automatically, and automate accruals and reconciliation.

Article

Ditch the spreadsheet. Track your budgets in Ramp.

Ramp Budgets monitors all your spend, live and integrated into a single platform, closing the loop between planning and execution, for the visibility you need.

Article

Ramp at $32 billion: Money talks. Now it thinks.

Ramp's underlying profitability is growing 153% year over year, 10x faster each year than the median publicly traded SaaS company.

Business credit cards

View all

Article

Which high-limit business credit card is right for you? February 2026

The best high-limit business credit cards combine purchasing power with other benefits, like built-in expense management. See our top picks.

Article

How to get a business credit card with an EIN only

It is possible to get a business credit card with just an EIN, but your options will be limited. Here's what you need to know.

Article

What an LLC should look for in a business credit card

Business credit cards offer LLC owners a way to separate their business and personal finances while building credit. Here's what LLCs should look for in a card.

Expense management

View all

Article

How 1,000+ teams automated expense reviews — and eliminated hidden risk

More than 1,000 finance teams now use the Ramp Policy Agent, reclaiming 4-5 hours per week from manual reviews and catching 7x more out-of-policy spend.

Article

8 best corporate credit card expense management software platforms in 2026

Corporate credit card expense management software can save your company time and money. See our picks for the top tools and tips for choosing the best one.

Article

The best business expense tracking apps and tools of 2026

The best business expense tracking apps and platforms balance a strong feature set with ease of use and cost-effectiveness. Learn more about our top 7 picks.

Accounts payable

View all

Article

What is an ACH payment? How it works, costs, and timing

Learn what an ACH payment is, how it works, how to send one, typical processing times and fees, and whether ACH transfers are right for your business.

Article

Top BILL.com competitors: 6 stronger alternatives for AP automation in February 2026

BILL (Bill.com) provides AP automation solutions, but it's not the only option. Here's a comparison of the top 6 BILL alternatives & competitors for modern AP.

Article

How to build an ideal accounts payable approval process

The accounts payable approval process is how companies pay their bills accurately and on time. We outline how to build your ideal AP process in this guide.

AI

View all

Article

Ramp agents: Let finance teams do finance

Announcing our first set of AI agents, built and trained to think like your sharpest controller and work like a thousand of them—around the clock.

Article

The CFO AI digest: July 3

As the volume of AI news explodes each week, it can get hard to spot what really matters. We’re here to cut through the noise and spotlight what counts for finance teams.

This week’s stories mark a shift in how AI is being operationalized across finance, infrastructure, and governance. Digital workers are moving from RPA bots to actual agentic teammates. Supply chains are getting smarter, bringing new implications for cost of goods sold (COGS) and risk, as AI-driven optimization changes how teams forecast costs, manage inventory, and model disruptions. Your data is now a tradable asset, and you might be giving it away for free. Compliance is getting more complex, with individual states rolling out their own AI laws.

For finance leaders, these stories are a call to re-architect your stack and strategy. Amid disruption lies an opportunity: those who adapt now set the pace for the future.

Article

Applied AI in finance: 4 tactics to automate advanced reporting

Discover how finance professionals can use generative AI to create financial reports and models for them with Nicolas Boucher, founder of the AI Finance Club.

Accounting

View all

Article

Best AI accounting tools to adopt in 2026

In 2026, the question isn't whether to adopt AI accounting tools, but which ones to use. Find the best options in our guide to the best AI accounting software.

Article

How to use AI safely in accounting

Learn how to balance automation with accountability in our guide on safe AI use in accounting, including tips for security, compliance, and human oversight.

Article

Best accounting software for small businesses in 2026

The best accounting software for small businesses in 2026, including QuickBooks, Xero, Wave, and more, compared by features, pricing, and use case.

Procurement

View all

Article

Living by our own ethos: How Ramp saved time and money with Ramp Procurement

Ramp's Senior FP&A Manager, Peter Mark, shares how Ramp saved 6 hours of review time per month & $350k in vendor spend by using Ramp Procurement.

Article

Best procurement software: 7 platforms that streamline purchasing

Compare the 7 best procurement software of 2025, plus tips on how to choose the best procurement tool for your business.

Article

AI in procurement: Benefits, strategies, and 6 top tools to use

Check out our list of the 6 top AI procurement tools, including LevaData, Fairmarkit, and our own Ramp, along with benefits and strategies for implementing.

Business banking & treasury

View all

Article

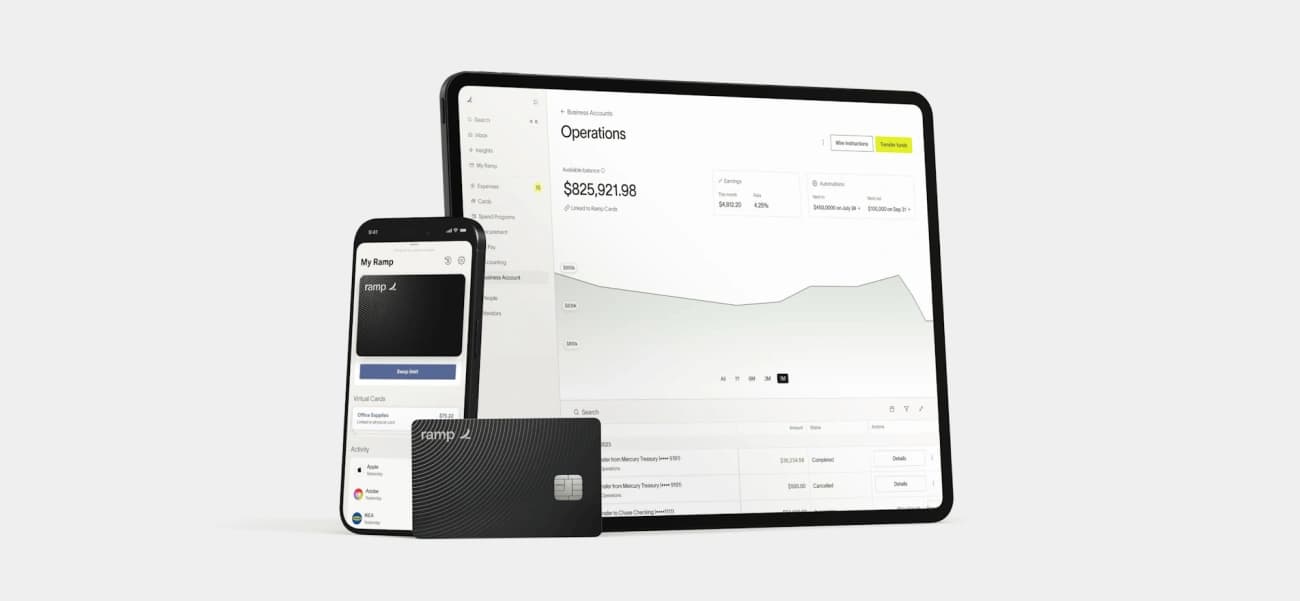

Introducing Ramp Treasury: Most banks hope you never see this.

Many banks make money by making their clients worse off – offering yield only if you lock up your cash with restrictions, minimums, transfer limits or brokerage sweeps. So businesses face a rough trade: earn 0% to keep cash accessible to pay bills, or lock it away to earn returns. Incentives of both parties - banks and customers - are misaligned.

Article

What is treasury management?

Treasury management is the strategic management of a company’s cash, liquidity, investments, payments, and financial risks.

Article

What is a treasury management system (TMS)?

Learn more about treasury management systems, their core functions and benefits, and how to choose the best TMS for you.

Recently published

Cash vs. accrual accounting: What's the difference?Cash accounting records transactions when cash moves. Accrual accounting records them when earned or incurred, regardless of payment timing.Feb 18

Cash vs. accrual accounting: What's the difference?Cash accounting records transactions when cash moves. Accrual accounting records them when earned or incurred, regardless of payment timing.Feb 18 Material procurement: Definition, process, steps, and typesMaterial procurement is the process of sourcing and purchasing raw materials and components needed for production, at the right cost and time.Feb 18

Material procurement: Definition, process, steps, and typesMaterial procurement is the process of sourcing and purchasing raw materials and components needed for production, at the right cost and time.Feb 18 What is a cash budget? Definition, importance, and exampleA cash budget projects your business’s cash inflows and outflows to help you prevent shortfalls, manage liquidity, and plan for growth.Feb 18

What is a cash budget? Definition, importance, and exampleA cash budget projects your business’s cash inflows and outflows to help you prevent shortfalls, manage liquidity, and plan for growth.Feb 18 Free cash flow (FCF): Definition and how to calculate itFree cash flow (FCF) is the cash left after operating expenses and CapEx. It shows how much cash you can use for debt, dividends, or growth.Feb 17

Free cash flow (FCF): Definition and how to calculate itFree cash flow (FCF) is the cash left after operating expenses and CapEx. It shows how much cash you can use for debt, dividends, or growth.Feb 17 Best accounting software for small businesses in 2026The best accounting software for small businesses in 2026, including QuickBooks, Xero, Wave, and more, compared by features, pricing, and use case.Feb 17

Best accounting software for small businesses in 2026The best accounting software for small businesses in 2026, including QuickBooks, Xero, Wave, and more, compared by features, pricing, and use case.Feb 17 Bad debt expense: Definition, formulas, and examplesBad debt expense is the estimated portion of accounts receivable you won’t collect, recorded as an operating expense and offset by an allowance.Feb 17

Bad debt expense: Definition, formulas, and examplesBad debt expense is the estimated portion of accounts receivable you won’t collect, recorded as an operating expense and offset by an allowance.Feb 17